In today’s rapidly advancing technological landscape, innovative solutions have become imperative in the fight against insurance fraud. With the rise of sophisticated schemes and tactics employed by fraudsters, traditional methods of detection and prevention are no longer sufficient. This is where insurance fraud video analysis and traffic surveillance come into play, offering a game-changing approach to identifying and mitigating fraudulent activities.

The Role of Insurance Fraud Video Analysis

Insurance fraud video analysis harnesses the power of artificial intelligence and machine learning algorithms to analyze video footage for signs of fraudulent behavior. By leveraging advanced video analytics technology, insurers can detect anomalies, patterns, and trends that indicate potential fraud. This proactive approach allows insurance companies to identify suspicious claims early on, preventing costly payouts and protecting their bottom line.

One of the leading providers of insurance fraud video analysis software is Cognitech. With over three decades of experience in the field of forensic video analysis, Cognitech offers cutting-edge solutions tailored to the specific needs of insurance providers. Their innovative software utilizes state-of-the-art algorithms to enhance video quality, extract valuable data, and analyze minute details that would otherwise go unnoticed.

The Benefits of Traffic Surveillance Analysis Software

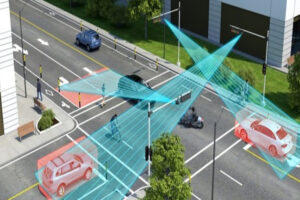

In conjunction with insurance fraud video analysis, traffic surveillance analysis software plays a crucial role in identifying fraudulent activities related to traffic accidents. By analyzing traffic camera footage, insurers can uncover discrepancies in reported incidents, such as staged accidents or exaggerated claims. This level of scrutiny and detail enables insurers to differentiate between legitimate claims and fraudulent attempts, ultimately minimizing financial losses and protecting against future risks.

Cognitech’s traffic surveillance analysis software offers a comprehensive solution for insurers looking to enhance their fraud detection capabilities. By integrating advanced video analytics tools, insurers can automate the process of reviewing traffic footage, flagging suspicious activities, and generating actionable insights. This streamlined approach not only saves time and resources but also improves the accuracy and efficiency of fraud detection efforts.

How Insurance Fraud Video Analysis and Traffic Surveillance work Together

When combined, insurance fraud video analysis and traffic surveillance analysis software create a powerful synergy that strengthens insurers’ ability to combat fraud. By analyzing video footage from multiple sources, insurers can cross-reference information, identify discrepancies, and build a comprehensive picture of each claim. This holistic approach enables insurers to detect sophisticated fraud schemes that may involve multiple parties and elaborate deceptions.

Moreover, the integration of these two innovative solutions allows insurers to gain a 360-degree view of each claim, from the initial incident to the final resolution. By utilizing AI-powered algorithms and advanced analytics tools, insurers can uncover hidden patterns, trends, and correlations that reveal the true nature of each claim. This level of insight empowers insurers to make informed decisions, mitigate risks, and protect their business from fraudulent activities.

Conclusion

In conclusion, insurance fraud video analysis and traffic surveillance analysis software represent a paradigm shift in the fight against fraudulent activities. By leveraging advanced technology, insurers can enhance their fraud detection capabilities, identify suspicious activities, and prevent fraudulent claims before they escalate. With Cognitech’s innovative solutions, insurers can stay one step ahead of fraudsters, protect their assets, and maintain the trust of their policyholders. By embracing these cutting-edge technologies, insurers can revolutionize their approach to fraud detection and prevention, ensuring a more secure and sustainable future for the insurance industry.